Courts are finding that when consumers sign a contract with a company and establish a bargained-for exchange they can no longer revoke consent to be contacted. This has broad implications for the collections industry as it relates to an agency’s ability to contact consumers on behalf of the clients they serve.

Please Note: This Article has been updated to include updated information published in the article, Common Sense Prevails... Part 2: Defining an ATDS.

Last month, the Northern District of Alabama cited a groundbreaking opinion by the Second Circuit Court of Appeals from 2017 to award summary judgement to the defendant in a lawsuit which saw the plaintiff alleging violations of the Telephone Consumer Protection Act (TCPA) by a collection agency.*

This case has broad implications for the collections industry as it relates to an agency’s ability to contact consumers on behalf of the clients they serve. It essentially says that because the consumer consented to be contacted by the original creditor “and/or any debt collection agency” they hired, via an automated predictive dialing system, the agency in question did not violate elements of the Telephone Consumer Protection Act (TCPA) even after the consumer verbally revoked consent because the original contractual consent cannot be unilaterally revoked.

The court essentially found that the common law concept of consent applied to the situation because there was a contractual obligation that superseded the verbal request. The consumer offered this consent in a bargained-for exchange and therefore could no longer unilaterally revoke that consent after the fact.

This a long and arduous way of saying that common sense finally prevails. Once the consumer signs a contract stipulating that they are giving their consent to be contacted by a debt collector using dialing technologies it cannot be pulled back on a whim because the consumer doesn’t feel like paying their bill. It is also a strong statement in support of using this type of language in a provider’s patient agreements and consumer contracts thereby giving their third-party collection agency a broader stroke in recovering the hard-earned money they are owed.

This also has far-reaching implications with regard to accepted modes of communication and should not be limited specifically to telephonic channels as can be seen in the actual contractual language.

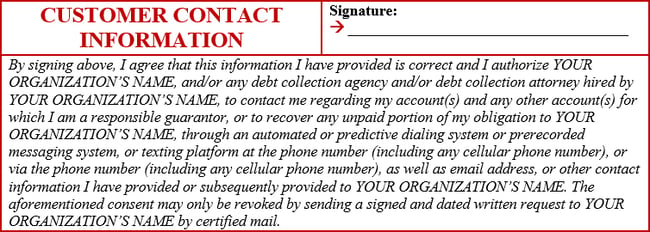

By using the following language in your consumer contracts and patient agreements, you ensure that your organization, as well as any organization you hire, will be able to use any and all means necessary to communicate with your potential debtors (Please note, this text has been updated to reflect more accurate wording presented as an example in Common Sense Prevails... Part 2: Defining an ATDS):

What many first-party billers are adding to their patient intake forms or consumer contracts are signatory statements like this:

An example of a statement that allows third-party collectors to contact consumers using numerous channels and technology.Please note that we are not attorneys and cannot provide legal advice. We are simply writing about this topic. A statement like this should be reviewed by your own legal counsel before it is put into official use.

Obtaining this type of explicit consent from your consumers will empower your third-party agencies to pursue this debt using modern and preferred methods of communication, which will, without a doubt, increase the amount of money your agency can collect on your behalf.

The decision by the courts is a welcome illustration of common sense prevailing in an over-regulated industry. However, the real common sense is only exercised in full when you incorporate this language into your actual contracts and patient agreements. Until then, this open window is closed to your organization and puts you and your chosen debt collector at a decided disadvantage.

*The Northern District of Alabama cited the groundbreaking opinion by the Second Circuit Court of Appeals from the case of Reyes, Jr. v. Lincoln Automotive Financial Services , 861 F.3d 51 (2d Cir. 2017) in its decision in Few v. Receivables Performance Mgmt. , No. 1:17-cv-02038 (N.D. Ala. Aug. 8, 2018). The Northern District of Alabama used the Reyes reasoning in granting the defendant’s amended summary judgment motion. While the Second Circuit’s opinion focuses only on the TCPA and is only binding within the Second Circuit, the fact that the Norther District of Alabama used it shows that its reasoning is broad enough to take root in other parts of the country (as is the historical nature of the Second Circuit Court of Appeals).

For more helpful topics, sign up for our monthly e-newsletter, "Billing & Collections Adviser" by clicking this link (or filling out the form on this page):