With the Coronavirus Pandemic wreaking havoc across the board for retailers, physicians, and healthcare organizations, furloughs and layoffs have become a daily assault on our newsfeeds and colleagues’ livelihoods. With this in mind, it might be time for you to start thinking about accelerating your bad debt collections and letting your specialized third-party collectors handle your accounts sooner. Just like the services your organization expertly provides, debt collection is a specialized service that is best left to the professionals so you can get back to doing what you do best, and often do exceptionally well.

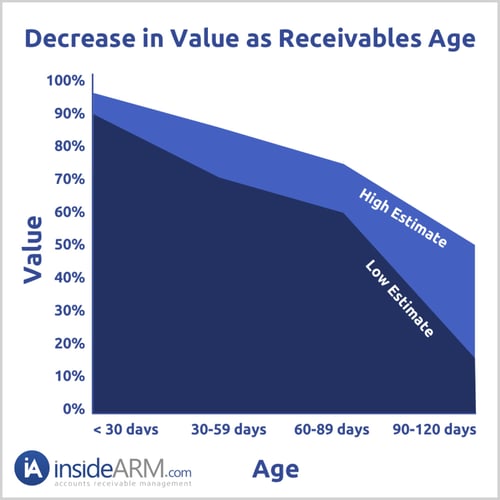

As we’ve previously noted, the law of diminishing returns shows that that the longer an accounts sits, the less chance there is to collect it. This is a commonsense conclusion backed up by research performed by InsideARM, a leading accounts receivable management group. You can see this illustrated in their graph below. Your best chance of collecting any debt is in the first thirty days. By day-60, you will see your chances of collecting nearly cut in half, followed by a precipitous drop through days 90-120. At this point, you are kicking rocks, and it’s much better to place these with an agency that specializes in collecting bad debt.

Additionally, your accounts receivable are considered a tangible asset on your balance sheet, especially with regard to obtaining financing. A bank can use your receivables as collateral in establishing loan terms. However, as noted in the previous reason, these receivables lose value over time, and by day-90, they no longer carry any value in this regard. At this point, there is literally no reason to hold these accounts back from collections unless you have established acceptable payment terms that are being met on time each week or month.

Finally, it has been shown that in order to recover the loss of one dollar a company working at a high margin of profit of twenty percent, would have to bring in five dollars for every dollar it loses to non-payment. Not only that, for organizations that operate at smaller margins, for instance four percent, it can take up to $25 to do so.

So, as long as these debts are in default (as defined in your policies and procedures), Simon’s provides a service that falls within the same traditional consumer protections as outlined in the Fair Debt Collection Practices Act (FDCPA). We will accelerate the collection of these debts if you place them sooner with our agency. Oftentimes, we can offer a slightly reduced rate in doing so. For more information, please visit our Simon’s Accelerator webpage or talk to your sales representative to see how Simon’s can accelerate your backend A/R collections

For more information about Simon’s Accelerator Program, click here.

Simon’s Agency has regularly discussed these topics during webinars and at conferences across the United States. If you’d like Simon’s to present on these topics for your group, please visit our Request a Speaker page.

For more helpful topics, sign up for our monthly e-newsletter, "Simon's Says" by clicking this link (or filling out the form on this page):