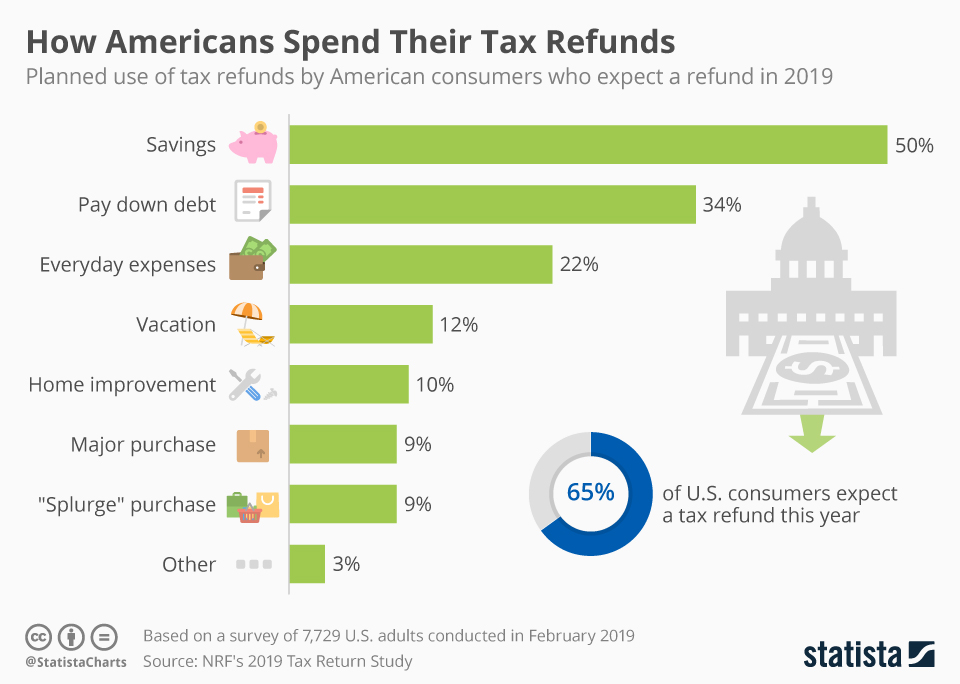

Every year, we begin pushing our clients to get their placements in ahead of the new year in an effort to have those accounts optimally primed for tax season. With 44% of taxpayers expecting their returns to be the wealthiest check they’ll bring home this year, opportunity abounds for all accounts receivable professionals. Each year, over half of recipients use at least a portion of this money to pay down debt or their everyday expenses.

For our clients this means you too have the opportunity to join in on the fruits of tax season. And that season has arrived in full as the IRS started accepting returns on January 27 which means for those who e-filed, the first refunds should start rolling in now with those who mailed in their returns to start receiving their refunds in early March. GoBankingRates.com provides a chart that gives an estimate of when refunds should be received based on when the returns were e-filed. When you are talking to your patients and consumers and they indicate they are planning on paying you with their refund, this chart can give you a reasonable idea of when you should expect to see that payment or when you might want to follow up with a reminder.

| 2020 IRS Tax Refund Calendar: When Will I Get My Tax Refund? | |

| Date the IRS Receives Your Return | Date You Can Expect Your Tax Refund |

| Jan. 28, 2020 – Feb. 2, 2020 | Feb. 18, 2020 |

| Feb. 3, 2020 – Feb. 9, 2020 | Feb. 23, 2020 |

| Feb. 10, 2020 – Feb. 16, 2020 | March 3, 2020 |

| Feb. 17, 2020 – Feb. 23, 2020 | March 10, 2020 |

| Feb. 24, 2020- March 2, 2020 | March 17, 2020 |

| March 3, 2019 – March 9, 2019. | March 25, 2019 |

| March 10, 2019 – March 16, 2019 | March 31, 2019 |

| March 17, 2019 – March 23, 2019 | April 7, 2019 |

| March 24, 2019 – March 30, 2019 | April 14, 2019 |

| March 31, 2019 – April 6, 2019 | April 21, 2019 |

| April 7, 2019 – April 13, 2019 | April 28, 2019 |

| April 14, 2019 – April 15, 2019 | May 5, 2019 |

| Estimates are based on the less than 21-day return window for e-filing, measured from the earliest date in each cell under the “return” column. | |

Finally, if you act now to get your collection accounts in, you can still take advantage of the last weeks of returns, but that time is quickly fading. However, for your own first-party accounts, you are just entering the most lucrative part of the year for many of your patients and customers. Be sure to take advantage of the next ten weeks by using tax season to your organization’s benefit.

For more helpful topics, sign up for our monthly e-newsletter, "Billing & Collections Adviser" by clicking this link (or filling out the form on this page):